Research the best investors in the world with their holdings reports

More data comming soon

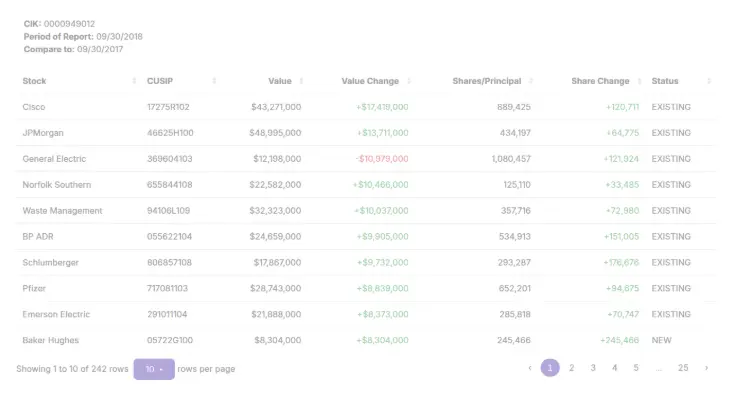

Here you can find the holding reports of big institutional investment managers since 2014, clean, and easy to search, of course you can have comparison with your wish period.

But it won't be the only thing we offer, we will provide more clean and useful data soon.

More about SEC 13F Holdings Report?

SEC 13F Holdings Report provides a wealth of information about institutional investment trends.

What is an SEC 13F Filing?

The SEC 13F filing is a quarterly disclosure required from institutional investment managers that oversee at least $100 million in assets under management (AUM). These managers must report their holdings of publicly traded U.S. securities, providing a snapshot of their investment portfolios.

Institutions required to file include:

- Hedge funds

- Mutual funds

- Pension funds

- Investment advisory firms

The report focuses on specific securities referred to as "13F securities", such as U.S.-listed stocks, certain convertible bonds, and options.

Key Information in a 13F Filing

The 13F filing must include the following details:

- Securities held: Names and descriptions of the securities (e.g., stock tickers or bond types).

- Quantity: Number of shares or units held.

- Market value: Dollar value of the holdings.

- Manager details: Name and relevant information about the reporting institution.

The list of securities that qualify as "13F securities" is periodically updated by the SEC.

Filing Deadlines

13F reports are submitted quarterly:

- They must be filed within 45 days after the end of each calendar quarter.

- The report reflects holdings as of the last day of the previous quarter.

For example, a 13F filing for Q1 2024 must be submitted by May 15, 2024.

Purpose and Significance

- Market Transparency: 13F filings help investors understand the trading behavior of major institutional players.

- Investment Insights: Retail investors and analysts often use these filings to study the strategies of renowned firms (e.g., Berkshire Hathaway, Bridgewater Associates).

- Regulatory Oversight: Regulators can monitor market activities and detect potential systemic risks.

Who Must File a 13F?

The filing requirement applies to institutional investment managers who:

- Manage at least $100 million or more in assets.

- Hold 13F securities, as defined by the SEC.

Common filers include:

- Public and private funds

- Investment banks

- Pension funds

- Insurance companies

- Investment advisory firms

Individual investors are typically exempt unless they operate as investment managers with qualifying AUM.